Financial Football: A Fun Way to Learn About Finance. Discover Financial Football – a fun & interactive game that makes learning about finance easy! Score knowledge on budgeting. Saving, & investing while you play!

What is Financial Football: A Fun Way To Learn About Finance & how does it work?

Financial Football represents an interactive game. Players learn finance concepts while enjoying football. Players answer questions correctly for advancing downfield. This game blends sports with financial education seamlessly. Participants engage with real-world scenarios throughout gameplay. Each question requires strategic thinking & decision-making skills. Understanding personal finance becomes an exciting challenge.

Brief history of Financial Football: A Fun Way To Learn About Finance

This game emerged around The late 2000s. Developers aimed for a creative approach towards financial literacy. Initial versions gained traction in schools across various states. Eventually. Organizations recognized its potential for engaging young audiences. Growth occurred as educational institutions adopted its curriculum. Now. Students enjoy a longstanding tradition of blending finance with athletics.

How To implement Financial Football: A Fun Way To Learn About Finance effectively

Schools & organizations can implement this game easily. First. Secure access To game materials online. Next. Gather students or participants eager for learning. Divide players into teams. Fostering healthy competition. Encourage collaboration within teams for answering questions. Set time limits for each round. Maintaining engagement. Regular practice sessions enhance student interest & understanding.

Key benefits of using Financial Football: A Fun Way To Learn About Finance

Players cultivate critical thinking & problem-solving skills. Engagement increases as participants enjoy playful learning. Financial concepts become relatable through real-life examples. Collaboration strengthens teamwork among students. Additionally. Participants boost their retention of financial information. Long-term benefits include improved financial literacy levels. Confidence grows as students navigate complex financial topics successfully.

Challenges with Financial Football: A Fun Way To Learn About Finance & potential solutions

Some challenges may arise while implementing this game. Limited resources might hinder access for some schools. Addressing technological disparities ensures every student participates. Moreover. Varying skill levels can create disparities among teams. Tailoring questions appropriately levels playing fields. Providing extra support for struggling players enhances overall experience.

Future of Financial Football: A Fun Way To Learn About Finance

Future trends indicate growing integration of technology. Virtual reality could simulate immersive financial environments. Mobile applications can allow play anywhere. Anytime. Additionally. Partnerships with educational institutions may expand reach. Continuous updates will keep content relevant & engaging. Ultimately. Evolution will promote further financial literacy for future generations.

Table of Financial Football: A Fun Way To Learn About Finance

Here follows a basic outline of Financial Football:

- Categories: Budgeting. Investing. Credit. Insurance

- Game Format: Team-based competition

- Duration: 30-60 minutes per session

- Ideal Age Group: 12-18 years

- Locations: Schools. Community centers

Understanding Financial Football

Financial Football offers an engaging way for individuals. Especially students. To grasp important principles around finance. This educational game integrates elements of American football with lessons on budgeting. Saving. Investing, & other financial topics. Players must answer questions correctly To advance down a virtual football field. Making finance fun & interactive. For those wanting more information. Check out Financial Football’s official site.

Each question posed within this game can range from basic knowledge of money management To more complex investment strategies. As players navigate through challenges. They not only learn how important financial decisions affect their lives but also appreciate how finances shape larger communities. This game engages both adults & children. Making financial lessons relatable & memorable.

How Financial Football Works

Financial Football combines gaming with educational content. Focusing on adult & youth financial literacy. Players step into interactive roles. Akin To football players on a field. Striking visuals & audio create an immersive experience. Players engage with various questions during their gameplay. Prompting critical thinking & knowledge application.

Throughout each level. Financial concepts are broken down into digestible portions. Decisionmaking occurs in realtime. Simulating realworld scenarios where financial acumen plays a vital role. Correct answers move players forward. While wrong answers prompt helpful explanations. This mechanism ensures learning through practice. Fostering critical skills needed in managing personal finances.

This setup encourages participation & promotes a team atmosphere. Engaging friends & family enhances motivation while achieving collective goals. Players can improve knowledge as they play in groups or compete against one another. Friendly competition keeps participants engaged while learning fundamental concepts about finance. Ensuring education remains entertaining.

Benefits of Playing Financial Football

Financial Football possesses several benefits that extend beyond mere entertainment. First. This game develops practical financial skills. Understanding loans. Interest rates. Investments. Budgeting, & savings allows individuals To make informed decisions throughout their lives. Players gain insights that lend themselves well toward financial independence.

Additionally. The game boosts critical thinking capabilities. Players must assess information. Analyze options, & predict outcomes while answering questions. This mental exercise enhances cognitive functions. Further aiding in problemsolving skills. Engaging with complex financial scenarios boosts overall confidence when addressing reallife finances.

Moreover. Players develop a sense of teamwork & collaboration while engaging in Financial Football. Cooperation promotes collective problemsolving. It also instills a sense of camaraderie. Further enhancing overall experiences. Learning together reinforces concepts. Nurturing bonds among players while fostering support for one another.

Content Covered in Financial Football

Content in Financial Football emphasizes various important financial topics. These topics serve as foundation for players interested in enhancing their financial literacy. Subjects range from basic budgeting fundamentals To understanding credit scores. All topics remain relevant. Appealing, & practical for everyday life.

Players encounter questions related To savings. Such as strategies for building an emergency fund or distinguishing between needs & wants. Understanding savings goals helps lay groundwork for future financial success. Moreover. Concepts surrounding investments. Such as stocks & bonds. Introduce opportunities for financial growth.

Finally. The game covers important lessons on responsible borrowing. Players learn about loans. Credit cards, & effective debt management strategies. All knowledge conveyed through this game remains crucial. Equipping players with necessary life skills essential for achieving longterm financial stability.

Engaging with Financial Footbal

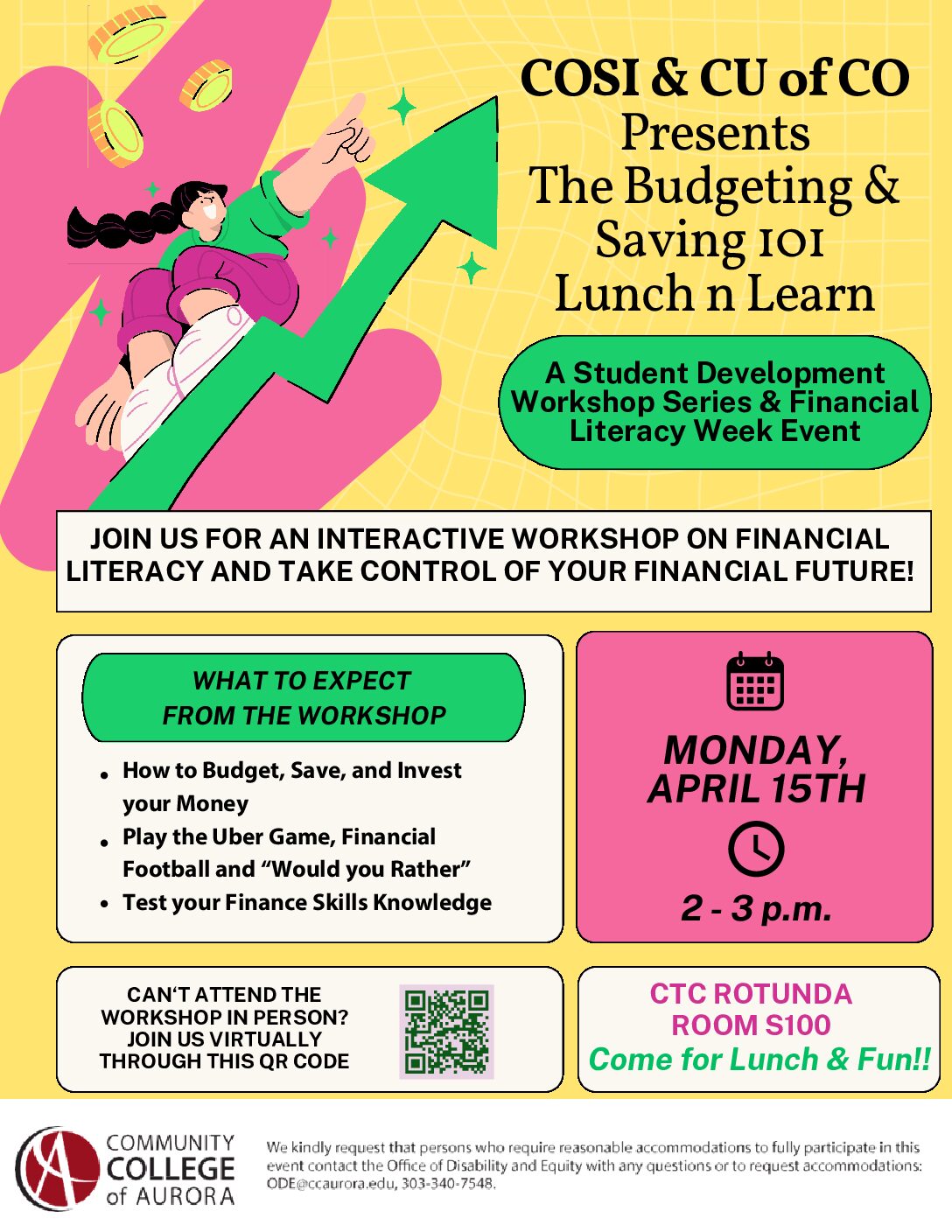

Players can access Financial Football through various platforms. Including schools or community organizations. Engaging during workshops or seminars fosters collaboration & encourages communication around finance. Technology ensures individuals can participate anywhere. Promoting greater accessibility.

The digital nature of The game allows participants To learn at their own pace. Making adjustments where necessary. This flexibility accommodates differing learning styles. Ensuring everyone gets a fair shot at mastering financial concepts. Choices in gameplay increase confidence while providing instant feedback To players.

Furthermore. Engaging with this platform transforms financial education into something dynamic. Interactive, & fun. Traditional methods often fall flat. Failing To engage modern learners. In contrast. Financial Football encourages exploration. Participation, & enjoyment. Addressing this essential void in learning finance.

RealWorld Applications

Understanding what players learn in Financial Football translates directly into realworld applications. Navigating finances can be daunting. Especially for younger generations. By introducing topics like budgeting. Investment options, & credit scores in a fun manner. Players can better retain information & apply their knowledge effectively.

Utilizing principles learned from gameplay. Individuals can make wiser decisions regarding cash flow management. Players will find themselves more prepared To tackle expenses. Plan for future purchases. Formulate budgets, & explore investment opportunities. Knowledge gained transforms into actionable steps. Enabling players To enhance their financial outcomes.

Every question answered correctly reinforces concepts carefully & practically. This built foundation proves invaluable in The working world. Individuals who grasp financial principles demonstrate preparedness To engage with challenges that adult life may present. Setting them apart as informed decisionmakers.

Features of Financial Football

- 🏈 Interactive gameplay promoting financial literacy

- 💰 Engaging quizzes on reallife financial scenarios

- 📊 Various levels catering To different knowledge bases

- 🌍 Accessibility across devices & platforms

- 🤝 Collaborative play encouraging teamwork

Target Audience for Financial Football

Although suitable for all ages. Financial Football primarily targets adolescents & young adults. Engaging students during their formative years helps equip them with crucial knowledge before they enter adulthood. Introducing essential principles early fosters habits that lead toward financial independence.

Schools & educational institutions often integrate this game into their curricula. Facilitating handson learning experiences helps students understand complex topics effectively. Moreover. Financial institutions & community organizations promote Financial Football as part of their literacy programs. Enhancing outreach To diverse audiences.

Families also benefit tremendously from this game. Parents can create fun opportunities for discussion around finances with their children. Teaching important lessons together strengthens bonds while fostering an open dialogue about personal finances. This collaborative aspect encourages responsible financial behavior amongst all family members.

Challenges Faced When Teaching Finance

When teaching finance. Several challenges arise that can hinder effective learning. One major issue stems from misinformation surrounding personal finances. Students may develop adverse feelings toward finance due To negative preconceived notions. Financial Football helps counteract such biases by making finance engaging & accessible.

Additionally. A lack of realworld experience often complicates comprehension. Traditional academic settings may not prepare students for practical financial situations. Using an interactive platform allows for experiential learning. Bridging gaps between theory & practice while equipping players with valuable skills.

Finally. Inadequate resources present yet another hurdle. Many schools struggle with outdated materials regarding financial education. Financial Football addresses this need by providing vibrant. UpTodate content that resonates with today’s youth. Resources remain vital for engaging learners & preparing them effectively for future finance challenges.

Creating a Fun Learning Environment

Structuring a positive. Fun learning environment significantly impacts financial education. Financial Football thrives on this principle. Ensuring participants enjoy their sessions. Fun social interactions. Competition, & friendly banter help alleviate anxiety surrounding finances. Allowing individuals To learn comfortably.

Encouraging collaboration among players fosters engagement & excitement. Group challenges inspire communication & teamwork. Turning learning into a shared experience. By promoting camaraderie while addressing financial topics. Participants are more likely To remember what they learn & apply these lessons outside of gameplay.

Utilizing various teaching methods enhances participant engagement levels further. Teachers can implement diverse approaches like visual aids. Group conversations. Or roleplaying scenarios within Financial Football. Establishing multifaceted experiences ensures learners access content differently. Accommodating their unique learning styles.

The Future of Financial Education

The future of financial education remains bright with tools like Financial Football paving pathways toward knowledge dissemination. Game mechanics connected with financial literacy continue To thrive & evolve as institutions embrace technology. Building effective strategies helps instill vital skills in students as they prepare for adulthood.

Emerging technologies will add layers of immersion & interactivity previously unattainable. Virtual reality & augmented reality applications could supplement financial education. Ensuring learners can experience concepts in engaging ways. Additionally. Artificial intelligence can personalize content delivery based on individual learning patterns.

As society becomes increasingly complex financially. Embracing innovative solutions becomes essential. Utilizing games like Financial Football creates an environment where students are ready To confront financial challenges headon. Such initiatives allow individuals To build meaningful skills while enjoying their educational journey.

Personal Experience with Financial Football

Having engaged with Financial Football during a financial literacy seminar. I can attest To its effectiveness. The gameplay fostered discussions in a relaxed atmosphere while providing educational value. Playing alongside peers increased my confidence in navigating financial topics that once seemed daunting. Grasping new concepts amid friendly competition made every lesson memorable.

Advocating for Financial Literacy

Advancing financial literacy introduces significant benefits across diverse populations. Increased awareness fosters empowerment. Promoting informed decisionmaking within communities. Engaging programs like Financial Football mobilize participants towards greater understanding. Sustaining motivation To learn about responsible financial management.

Education generates conversation around financial topics. But advocacy remains essential. Encouraging schools & tribes within communities To prioritize financial literacy prepares individuals for successful futures. Establishing initiatives around education ensures future generations possess necessary skills for everyday financial challenges.

Finance no longer should remain a taboo topic. Encouraging open discussion about money management. Budgeting, & investment paves pathways toward a financially healthier society. Employing tools like Financial Football helps break barriers while fostering collaboration. Understanding, & kindness in education surrounding finances.

Understanding Financial Literacy Through Gameplay

Financial literacy remains crucial for all individuals. Games can effectively teach various concepts in finance. Financial Football utilizes excitement from sports To enhance learning. Players gain knowledge while enjoying a competitive game atmosphere. Financial Football incorporates key financial skills like budgeting. Saving, & investing.

This game highlights essential financial principles through engaging scenarios. Players encounter realworld situations that require sound financial decisions. Common pitfalls. Such as overspending. Become apparent when navigating challenges. This engaging format encourages players To think critically about their financial choices.

For additional resources on financial literacy. Check out Financial Football resources. Another valuable resource can be found at Practical Money Skills. Both links provide useful information for enhancing financial knowledge.

Game Mechanics & Features

Financial Football employs familiar football concepts within gameplay. Players choose a team & navigate through match scenarios. Scenarios include deciding on investments or managing budgets. This connection between finance & sports captivates participants.

Each decision impacts game progress. Leading players To crucial learning experiences. Score touchdowns by answering financial questions correctly. Progressing through levels strengthens knowledge & improves decisionmaking skills. Concepts become clear as players experience consequences of their choices.

Game mechanics keep players engaged while enhancing financial comprehension. Users strengthen analytical skills through repeated play. Players often think about their financial strategies beyond game sessions. Altogether. This creates an immersive learning environment.

Importance of Financial Education

Understanding finance equips individuals with necessary life skills. Knowledge about saving. Budgeting, & investing prepares one for future challenges. This foundation helps people make informed decisions. Financial Football brings this knowledge into an entertaining context.

Financial education helps individuals avoid common mistakes. Many people face challenges related To debt & insufficient savings. Learning through Financial Football provides strategies for overcoming such issues. Engaging in gameplay fosters a positive attitude toward finances.

Longterm benefits arise from understanding personal finance. Improved financial decisions lead To increased savings & reduced debt levels. Therefore. Educating oneself about finances becomes critical for success. Players can learn through this enjoyable footballthemed experience.

Target Audience for Financial Football

Financial Football appeals To diverse audiences. Students benefit greatly from interactive learning experiences. Schools often integrate this game To enhance financial literacy programs. Parents can also play alongside children. Strengthening familial bonds.

Corporate settings recognize value in team engagement activities. Financial Football can be an effective tool for employee training. Easily adaptable for workshops. Organizations utilize this resource for skill development. Professionals will benefit significantly from enhanced financial knowledge.

Community programs often use such games for outreach. They aim To enhance financial literacy within local populations. Diverse groups find common ground through learning activities. Using Financial Football allows participants from various backgrounds To engage.

Comparison of Financial Football with Other Learning Methods

| Feature | Financial Football 🏈 | Traditional Learning 📚 | Online Courses 💻 |

|---|---|---|---|

| Engagement Level | High | Medium | Variable |

| Interactivity | High | Low | Medium |

| Realworld Application | Excellent | Good | Good |

| Team Activity | Yes | No | No |

| Accessibility | Easy | Medium | Easy |

Experiential Learning in Financial Football

My experience with Financial Football proved enlightening. Playing this game reshaped my understanding of finances. Facing challenges within gameplay offered a fresh perspective. I realized how essential strategies become in reallife situations.

Every decision created motivation for learning. Financial concepts that seemed complex transformed into manageable tasks. Through gameplay. I discovered my strengths & weaknesses in financial literacy. This journey proved worthwhile. Enhancing my overall confidence.

Feedback & Improvements

Players often provide valuable feedback on game experience. Constructive criticism helps improve gameplay & educational elements. Developers actively seek input from participants To enhance financial understanding.

Future updates will incorporate suggestions from experienced players. Adjustments ensure that Financial Football remains relevant in an everchanging financial landscape. Technical improvements will ensure better gameplay & accessibility.

Listening To players enhances engagement & enjoyment. It promotes a sense of community. Making learning collaborative. Participants become invested in gameplay. Leading them toward better financial literacy.

Building a Financial Future Through Fun

Integrating financial education into enjoyable activities prepares individuals for realworld scenarios. Financial Football demonstrates that learning can be engaging & impactful. Participants develop skills that benefit them throughout life.

Through fun gameplay. Players gain confidence in managing finances. Knowledge acquired through play leads To informed decisions in daily life. This context encourages individuals To take ownership of their financial futures.

Enjoyable experiences often lead To lasting understanding. Building financial awareness through games fosters a positive view of finance. Financial Football champions The idea that learning doesn’t have To be boring.

What is Financial Football?

Financial Football is an interactive educational game designed To teach players about personal finance concepts while engaging them in a fun & competitive environment. It combines elements of football with important financial lessons.

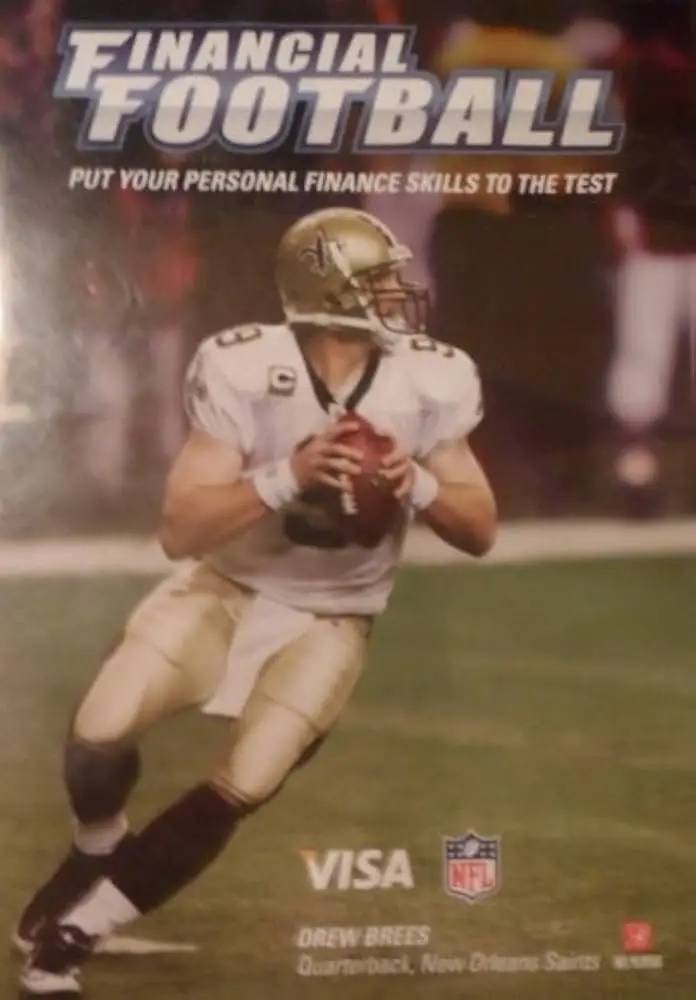

Who developed Financial Football?

Financial Football was developed by Visa in collaboration with NFL. It aims To provide an entertaining way for people. Particularly young adults. To improve their financial literacy through gameplay.

How can I access Financial Football?

Financial Football can be accessed online through The official Visa website & various educational platforms that partner with Visa. Players usually do not need To download any software To enjoy The game.

Is Financial Football suitable for all ages?

Yes. Financial Football is designed for players of all ages. But it is particularly targeted towards high school students & young adults To help them develop essential financial skills.

What kind of financial topics are covered in The game?

The game covers a variety of topics. Including budgeting. Saving. Investing. Credit management, & understanding financial products. Each question & scenario helps reinforce these concepts.

Can Financial Football be used in a classroom setting?

Absolutely! Financial Football can be a great tool for educators To incorporate into personal finance lessons. Engaging students through interactive gameplay To reinforce their learning experience.

Are there different levels of difficulty in Financial Football?

Yes. Financial Football offers various levels of difficulty To accommodate players with different knowledge bases. This allows beginners To learn at their own pace while challenging more experienced players.

Is there a mobile version of Financial Football?

As of now. Financial Football is primarily webbased. But players can access it on mobile devices with internet capabilities. However. A dedicated mobile app may not be available.

How long does a typical game of Financial Football last?

The duration of a game can vary depending on The number of players & The pace of play. But a typical game lasts about 2030 minutes. Making it easy To fit into a busy schedule.

Can I play Financial Football alone?

Yes. Financial Football can be played solo against The computer. Allowing individuals To practice & improve their financial knowledge without needing a group of players.

What are The benefits of playing Financial Football?

Playing Financial Football helps players learn critical financial concepts. Improve their decisionmaking skills, & develop a better understanding of personal finance. All while enjoying a competitive & entertaining format.

Is there a cost associated with playing Financial Football?

No. Financial Football is free To play. It is designed To promote financial literacy without any cost To The player. Ensuring accessibility for everyone interested in learning.

How can I track my progress in Financial Football?

Players can track their progress through scores & feedback provided at The end of each game. This helps them understand which areas they excelled in & which topics they may want To review further.

Are there any prizes for playing Financial Football?

While Financial Football itself does not typically offer prizes. It provides valuable knowledge & skills that can lead To better financial decisions in real life. Which is a significant reward in itself.

How does Financial Football align with personal finance education?

Financial Football aligns with personal finance education by incorporating realworld financial scenarios into The game. Allowing players To apply what they learn in a fun & engaging manner. Thus reinforcing their financial knowledge.

Conclusion

In conclusion, Financial Football is an exciting & engaging way for everyone To learn about personal finance. By blending The fun of football with essential financial concepts, it makes learning enjoyable & memorable. Whether you’re just starting your financial journey or looking To sharpen your money skills, this game provides a fun platform for understanding budgeting, saving, & spending wisely. So, gather your friends or family, & kick off your financial education with Financial Football. Who knew learning about finance could be as thrilling as a touchdown? Get started today & score big with your money knowledge!